At the halfway point of 2025, uncertainty has once again taken center stage in capital markets.

The second quarter opened with a dramatic selloff as the S&P 500 dropped 4.3% in the matter of a few days. This was triggered by “Liberation Day” on April 2nd, a Trump Administration policy announcement introducing sweeping new U.S. tariffs on nearly all of its major trading partners. Investor reaction was swift: markets sold off sharply, only to rebound just as quickly as the administration reversed, delayed or adjusted its plans. In a surreal twist, the President encouraged his followers via social media to “buy the dip,” an unorthodox moment that underscored how unpredictable the policy environment has become in the United States.

Compounding global uncertainty is the continued war in Ukraine, where hopes for peace were dashed as the conflict escalated. Meanwhile, the Middle East has seen rising tensions spill over into direct confrontation with the United States recently engaging militarily in Iran.

Closer to home, the Canadian economy continued to slow. Unemployment recently breached 7% — the highest level (excluding COVID) since 2013 — while youth unemployment has surged above 15%. Consumers are tightening their wallets, housing activity is down, and business confidence is waning because of trade disruptions and a risk-off lending environment.

Despite all of this, capital markets have shown remarkable and surprising resilience. The S&P 500, S&P TSX 60 and the Nasdaq 100 each closed the second quarter at all-time highs. Investors, perhaps conditioned by years of monetary support, continue to view every selloff as a buying opportunity — even as uncertainty rises.

Performance of the Magnificent Seven

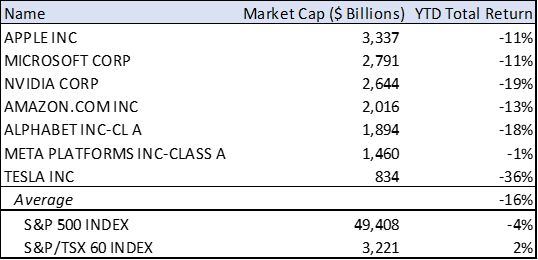

Last quarter, we noted that the entirety of the S&P 500’s year-to-date decline could be traced to the underperformance of its largest constituents: the so-called “Magnificent Seven.” In the first quarter of 2025, these mega-cap names collectively accounted for over 100% of the index’s drawdown. At the time, the broader market would have been modestly positive were it not for the pronounced $5.8 trillion market capitalization sell-off in this narrow cohort.

Liberation Day deepened those concerns, leading to another round of volatility and an accelerated selloff in many of the most widely held growth names. Since then, however, the picture has become more complex. While the S&P 500 has staged a strong recovery, the performance of the Magnificent Seven has been mixed. The group, once viewed as a monolith, has splintered — with some names rebounding sharply on the back of resilient earnings and artificial intelligence-related momentum, while others lagged amid rising input costs and supply-chain friction.

This growing dispersion underscores a shift in market leadership and challenges the notion that a handful of stocks can indefinitely carry the broader index. Investors are now parsing fundamentals more closely, with greater differentiation in pricing and positioning across the group.

We’ve updated the accompanying table to reflect these dynamics — showing how returns have diverged sharply within the Magnificent Seven since the April tariff announcements. For equity investors, this moment highlights both the risks of concentration and the opportunities embedded in fundamental, bottom-up analysis.

Currency Matters: The U.S. Dollar Retreats

One of the most consequential — and perhaps underappreciated — developments of the second quarter was the broad-based decline of the U.S. dollar.

The greenback weakened against nearly all major currencies as investors reassessed U.S. monetary policy in light of softening inflation data, rising fiscal concerns, and growing global de-dollarization narratives. A notable shift in expectations around future U.S. Federal Reserve rate cuts — combined with resilient economic performance in other regions — contributed to the steady depreciation of the U.S. dollar throughout the quarter.

For Canadian investors, the U.S.–Canadian dollar exchange rate was particularly relevant. The Canadian dollar appreciated by almost 6% relative to the U.S. dollar during Q2, a significant move that had meaningful implications for portfolio returns. While the S&P 500 posted a year-to-date total return of roughly 6% in U.S. dollars, that gain was largely eroded by currency effects. In Canadian dollar terms, the index was essentially flat.

This highlights an important dynamic for globally diversified investors: currency fluctuations can materially influence investment returns in the short term, particularly during periods of pronounced foreign exchange volatility like this most recent period. However, currency impacts tend to even out over longer time frames.

While the long-term trajectory of the U.S. dollar remains uncertain, the events of Q2 serve as a reminder that even the world’s reserve currency is not immune to shifting global sentiment.

EQUITIES

As noted, equity markets demonstrated considerable resilience. Despite geopolitical tension and trade policy volatility, companies in the S&P 500 delivered earnings growth of 12% year over year — an impressive result given the implied 20% tariff rate that many feared would derail corporate profitability.

What stood out was not just the strength of earnings, but also the confidence expressed by corporate management teams. Forward guidance was generally stronger than expected, and companies in the artificial intelligence, semiconductor and infrastructure sectors continued to benefit from long-term tailwinds. As a sign of balance sheet strength, U.S. corporates repurchased nearly $300 billion in shares in Q2.

Investor reaction to these developments was mixed. Retail investors have been net buyers, but institutional flows remain light. We are seeing what JPMorgan calls a “dual pain trade” — where equities are grinding higher despite subdued investor sentiment and increasingly narrow market leadership. U.S. mega-cap technology firms continue to dominate performance, while international equities and small caps lag the pack.

Structural advantages such as superior brand strength, intellectual property, regulatory protection, unique assets, high switching costs, and economies of scale, combined with strong balance sheets remain cornerstones of our investment framework. This strategic positioning ensures our portfolio remains not only resilient amid external shocks but also able to capitalize on emerging growth opportunities driven by structural economic changes, innovation, and global policy shifts.

FIXED INCOME

On the fixed income side, the picture is more nuanced. Both the Federal Reserve and the Bank of Canada held rates steady this quarter, citing persistent inflation pressures and uncertainty about the economic fallout from tariffs.

In the U.S., inflation has moderated but remains slightly above the Fed’s 2% target, with the latest data showing core inflation measured by the Personal Consumption Expenditures Price Index at 2.7%. The Fed’s June statement emphasized that while employment remains strong, downside risks to growth are building. Federal Reserve Chair Jerome Powell acknowledged tariff-driven uncertainty but indicated that the Committee is well-positioned to respond if needed, a stance interpreted by markets as dovish.

In Canada, the situation is more fragile. Inflation is hovering around 1.7%, and the labour market is softening. The Bank of Canada now expects second-quarter growth to slow significantly after a front-loaded boost in exports and inventory-building earlier in the year. Rate cuts remain on the table, but the Bank of Canada continues to assess the broader implications of employment, trade and housing weakness. The BoC’s next scheduled policy announcement is July 30th.

CLOSING THOUGHTS

If there is a theme this quarter, it is one of divergence: between rising geopolitical instability and market returns – albeit volatile ones; between a slowing economy and growing corporate profits; and between policy uncertainty and investor optimism. It is difficult to reconcile these signals — which is precisely why we remain disciplined in our approach to investing.

We continue to emphasize quality, diversification, and long-term thinking in every portfolio we manage. While headlines may shift quickly, our process remains rooted in fundamentals.

Nobody can predict interest rates, the future direction of the economy, or the stock market. Dismiss all such forecasts and concentrate on what’s actually happening to the companies in which you’ve invested. – Peter Lynch –

2025 Q2 Coleford Quarterly Commentary

Quarterly Commentary

SECOND QUARTER 2025

Executive Summary

Conservative. Consistent. Committed.

PORTFOLIO MANAGEMENT TEAM

MACRO ENVIRONMENT

At the halfway point of 2025, uncertainty has once again taken center stage in capital markets.

The second quarter opened with a dramatic selloff as the S&P 500 dropped 4.3% in the matter of a few days. This was triggered by “Liberation Day” on April 2nd, a Trump Administration policy announcement introducing sweeping new U.S. tariffs on nearly all of its major trading partners. Investor reaction was swift: markets sold off sharply, only to rebound just as quickly as the administration reversed, delayed or adjusted its plans. In a surreal twist, the President encouraged his followers via social media to “buy the dip,” an unorthodox moment that underscored how unpredictable the policy environment has become in the United States.

Compounding global uncertainty is the continued war in Ukraine, where hopes for peace were dashed as the conflict escalated. Meanwhile, the Middle East has seen rising tensions spill over into direct confrontation with the United States recently engaging militarily in Iran.

Closer to home, the Canadian economy continued to slow. Unemployment recently breached 7% — the highest level (excluding COVID) since 2013 — while youth unemployment has surged above 15%. Consumers are tightening their wallets, housing activity is down, and business confidence is waning because of trade disruptions and a risk-off lending environment.

Despite all of this, capital markets have shown remarkable and surprising resilience. The S&P 500, S&P TSX 60 and the Nasdaq 100 each closed the second quarter at all-time highs. Investors, perhaps conditioned by years of monetary support, continue to view every selloff as a buying opportunity — even as uncertainty rises.

Performance of the Magnificent Seven

Last quarter, we noted that the entirety of the S&P 500’s year-to-date decline could be traced to the underperformance of its largest constituents: the so-called “Magnificent Seven.” In the first quarter of 2025, these mega-cap names collectively accounted for over 100% of the index’s drawdown. At the time, the broader market would have been modestly positive were it not for the pronounced $5.8 trillion market capitalization sell-off in this narrow cohort.

Liberation Day deepened those concerns, leading to another round of volatility and an accelerated selloff in many of the most widely held growth names. Since then, however, the picture has become more complex. While the S&P 500 has staged a strong recovery, the performance of the Magnificent Seven has been mixed. The group, once viewed as a monolith, has splintered — with some names rebounding sharply on the back of resilient earnings and artificial intelligence-related momentum, while others lagged amid rising input costs and supply-chain friction.

This growing dispersion underscores a shift in market leadership and challenges the notion that a handful of stocks can indefinitely carry the broader index. Investors are now parsing fundamentals more closely, with greater differentiation in pricing and positioning across the group.

We’ve updated the accompanying table to reflect these dynamics — showing how returns have diverged sharply within the Magnificent Seven since the April tariff announcements. For equity investors, this moment highlights both the risks of concentration and the opportunities embedded in fundamental, bottom-up analysis.

Currency Matters: The U.S. Dollar Retreats

One of the most consequential — and perhaps underappreciated — developments of the second quarter was the broad-based decline of the U.S. dollar.

The greenback weakened against nearly all major currencies as investors reassessed U.S. monetary policy in light of softening inflation data, rising fiscal concerns, and growing global de-dollarization narratives. A notable shift in expectations around future U.S. Federal Reserve rate cuts — combined with resilient economic performance in other regions — contributed to the steady depreciation of the U.S. dollar throughout the quarter.

For Canadian investors, the U.S.–Canadian dollar exchange rate was particularly relevant. The Canadian dollar appreciated by almost 6% relative to the U.S. dollar during Q2, a significant move that had meaningful implications for portfolio returns. While the S&P 500 posted a year-to-date total return of roughly 6% in U.S. dollars, that gain was largely eroded by currency effects. In Canadian dollar terms, the index was essentially flat.

This highlights an important dynamic for globally diversified investors: currency fluctuations can materially influence investment returns in the short term, particularly during periods of pronounced foreign exchange volatility like this most recent period. However, currency impacts tend to even out over longer time frames.

While the long-term trajectory of the U.S. dollar remains uncertain, the events of Q2 serve as a reminder that even the world’s reserve currency is not immune to shifting global sentiment.

EQUITIES

As noted, equity markets demonstrated considerable resilience. Despite geopolitical tension and trade policy volatility, companies in the S&P 500 delivered earnings growth of 12% year over year — an impressive result given the implied 20% tariff rate that many feared would derail corporate profitability.

What stood out was not just the strength of earnings, but also the confidence expressed by corporate management teams. Forward guidance was generally stronger than expected, and companies in the artificial intelligence, semiconductor and infrastructure sectors continued to benefit from long-term tailwinds. As a sign of balance sheet strength, U.S. corporates repurchased nearly $300 billion in shares in Q2.

Investor reaction to these developments was mixed. Retail investors have been net buyers, but institutional flows remain light. We are seeing what JPMorgan calls a “dual pain trade” — where equities are grinding higher despite subdued investor sentiment and increasingly narrow market leadership. U.S. mega-cap technology firms continue to dominate performance, while international equities and small caps lag the pack.

Structural advantages such as superior brand strength, intellectual property, regulatory protection, unique assets, high switching costs, and economies of scale, combined with strong balance sheets remain cornerstones of our investment framework. This strategic positioning ensures our portfolio remains not only resilient amid external shocks but also able to capitalize on emerging growth opportunities driven by structural economic changes, innovation, and global policy shifts.

FIXED INCOME

On the fixed income side, the picture is more nuanced. Both the Federal Reserve and the Bank of Canada held rates steady this quarter, citing persistent inflation pressures and uncertainty about the economic fallout from tariffs.

In the U.S., inflation has moderated but remains slightly above the Fed’s 2% target, with the latest data showing core inflation measured by the Personal Consumption Expenditures Price Index at 2.7%. The Fed’s June statement emphasized that while employment remains strong, downside risks to growth are building. Federal Reserve Chair Jerome Powell acknowledged tariff-driven uncertainty but indicated that the Committee is well-positioned to respond if needed, a stance interpreted by markets as dovish.

In Canada, the situation is more fragile. Inflation is hovering around 1.7%, and the labour market is softening. The Bank of Canada now expects second-quarter growth to slow significantly after a front-loaded boost in exports and inventory-building earlier in the year. Rate cuts remain on the table, but the Bank of Canada continues to assess the broader implications of employment, trade and housing weakness. The BoC’s next scheduled policy announcement is July 30th.

CLOSING THOUGHTS

If there is a theme this quarter, it is one of divergence: between rising geopolitical instability and market returns – albeit volatile ones; between a slowing economy and growing corporate profits; and between policy uncertainty and investor optimism. It is difficult to reconcile these signals — which is precisely why we remain disciplined in our approach to investing.

We continue to emphasize quality, diversification, and long-term thinking in every portfolio we manage. While headlines may shift quickly, our process remains rooted in fundamentals.