Uncertainty created by potential tariff policy pronouncements and annexation threats by U.S. President Trump had a profoundly disruptive effect on capital markets in the first quarter. President Trump’s announcement of “Liberation Day,” on April 2, 2025, further exacerbated market apprehensions as the quarter drew to a close. While the Administration argues that these measures will bolster U.S. domestic industries, critics warned of potential repercussions, including higher prices and lower incomes for American families. Threats and counter threats led to significant volatility in global stock markets, with major indices in the U.S. and Japan experiencing notable declines.

Despite tariff headlines dominating the macro environment, Canada’s TSX60 index managed to deliver a positive return in the quarter. If tariffs were the only factor impacting markets, it would be reasonable to expect Canada – being consistently in the crosshairs of tariff threats – to be among the equity markets most negatively impacted by this turmoil. Given Canada’s proportionally significant trading relationship with the U.S., the current resilience of its equity markets suggests additional factors are at play. Indeed, Canada’s economy benefited from strong performance in commodities, notably energy and precious metals, which have historically acted as safe havens during periods of geopolitical uncertainty. A weaker Canadian dollar also provided a competitive advantage to Canadian exporters, potentially further supporting the domestic equity market.

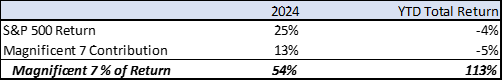

Of note, the entirety of the S&P 500’s year-to-date decline can be attributed to the underperformance of its largest constituents: the so-called “Magnificent Seven.” In 2024, these seven stocks accounted for over half of the S&P 500’s 25% total return. In the first quarter of 2025, they collectively accounted for over 100% of the YTD decline. In other words, the broader index would have been slightly positive were it not for the sharp pullback in these mega-cap names. This reversal highlights the extent to which market performance has become concentrated at the top and how vulnerable the S&P 500 Index can be when these names falter.

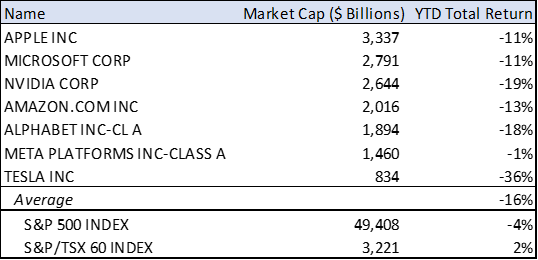

These mega-cap technology stocks saw average YTD declines of approximately 16%, driven by a sharp reversal in investor confidence. This volatility erased approximately $5.8 trillion in market capitalization from peak valuations. Investors have become increasingly cautious, reducing positions in growth and technology stocks and shifting towards defensive and lower-volatility sectors.

Performance of the Magnificent Seven

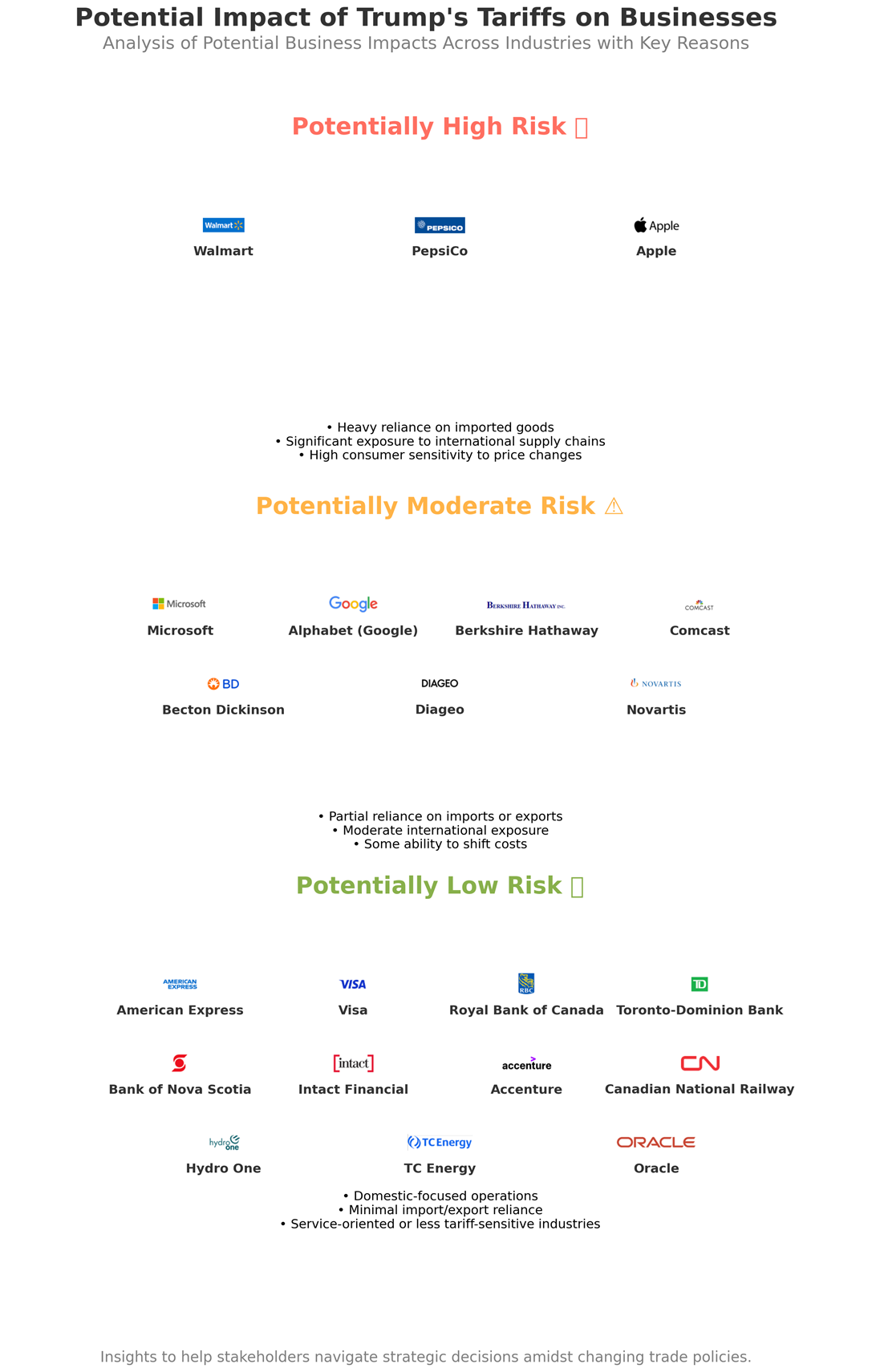

Tariff uncertainty also significantly impacted global supply chains, prompting numerous multinational corporations to reconsider their manufacturing and sourcing strategies. Companies across industries –from automotive and consumer electronics to apparel – began actively diversifying their operations geographically to mitigate potential disruptions from escalating U.S. protectionist policies. Economists highlighted these shifting supply-chain strategies as a potential structural change, likely to influence global trade patterns beyond this period of adjustment.

Global markets were further influenced by mixed economic signals. While the U.S. economy continued its robust pace, supported by resilient consumer spending and ongoing investments in technology infrastructure, concerns about global growth intensified. Europe faced renewed economic weakness amid rising energy costs and subdued consumer confidence, while emerging markets grappled with currency volatility and capital outflows, further complicated by the strong U.S. dollar.

Central banks worldwide responded cautiously. The U.S. Federal Reserve maintained its hawkish stance due to persistent inflation concerns and economic resilience, signalling potential further rate hikes if inflationary pressures persist. In contrast, the Bank of Canada, faced with slower domestic growth, maintained a more accommodative posture, highlighting the nuanced differences in economic trajectories between neighbouring countries. Elsewhere, monetary policy varied widely: the European Central Bank balanced inflation concerns and sluggish growth by refraining from aggressive moves, while central banks in emerging markets grappled with stabilizing currencies amid volatile capital flows.

In summary, the first quarter of 2025 was characterized by heightened volatility and uncertainty, driven by anticipated trade policies, shifting global supply chains, and broader geopolitical dynamics. These developments underscored the interconnectedness of global markets and the critical need for strategic, resilient investment approaches.

EQUITIES

In navigating this environment, Coleford remains committed to our disciplined, long-term investment philosophy. We focus on companies with strong competitive advantages, resilient business models, and ability to sustain growth independent of short-term market fluctuations.

Our investment team continues rigorous analyses of existing holdings and potential new investments. While acknowledging that every business inevitably faces secondary or tertiary impacts from potential tariffs and broader economic disruptions, our portfolio generally demonstrates lower “direct” vulnerability.

Buying and selling businesses based solely upon Presidential tweets will not be a successful strategy for creating wealth. However, we are mindful of the fact that certain policy decisions, however impulsively they may be presented, can have long-tail impacts on capital investment. We also recognize that the winds can shift relatively quickly. Historically, punishing tariff policies have not outlasted the Administrations that introduced them. Such is the case with the McKinley Tariff Act of 1890 which was replaced by lower tariffs under the Wilson–Gorman Tariff Act of 1894. Similarly, the Smoot–Hawley Tariff Act of 1930 was followed four years later by the Reciprocal Tariff Act, which significantly lowered tariffs through reciprocal international negotiations.

Structural advantages such as superior brand strength, intellectual property, regulatory protection, unique assets, high switching costs, and economies of scale, combined with strong balance sheets remain cornerstones of our investment framework. This strategic positioning ensures our portfolio remains not only resilient amid external shocks but also positioned to capitalize on emerging growth opportunities driven by structural economic changes, innovation, and global policy shifts.

FIXED INCOME

In the U.S., interest rates moderated slightly from the start of the year, however remained persistently high throughout the first quarter. This reflected ongoing strength in the U.S. economy, tight labour market conditions, and a cautious stance by the Federal Reserve. Elevated rates continue to have significant implications for bond markets, asset valuations, and currency dynamics. In particular, high interest rates supported relatively attractive yields in U.S. fixed income portfolios but simultaneously put pressure on equity valuations, particularly in high-duration sectors like technology and growth-oriented businesses.

In contrast, yields in the Canadian fixed income market continued to shift lower in the first quarter. On March 12, 2025, the Bank of Canada reduced its target for the overnight rate by 25 basis points to 2.75%. This marked the seventh consecutive rate cut since June 2024, and the 2nd reduction of the year, aimed at mitigating the economic uncertainty stemming from recent U.S. tariff threats. These rate reductions were intended to support Canadians in managing the challenges posed by trade tensions and were enacted despite concerns about potential inflationary outcomes. The Bank’s Governing Council emphasized the need for careful monitoring of the economy and indicated that future policy guidance would be inappropriate under the current circumstances.

CLOSING THOUGHTS

As we advance through 2025, our approach remains clear: navigating uncertainty with discipline, maintaining rigorous investment criteria, and staying committed to the long-term financial objectives of our clients. History demonstrates that periods of volatility and disruption often present opportunities for discerning investors. We are positioned to seize these opportunities while ensuring our clients’ portfolios remain resilient, well diversified, and strategically aligned to long-term wealth creation and preservation.

Great investment opportunities come around when excellent companies are surrounded by unusual circumstances that cause the stock to be misappraised.

– Warren Buffett –

2025 Q1 Coleford Quarterly Commentary

Quarterly Commentary

FIRST QUARTER 2025

Executive Summary

Conservative. Consistent. Committed.

PORTFOLIO MANAGEMENT TEAM

MACRO ENVIRONMENT

Uncertainty created by potential tariff policy pronouncements and annexation threats by U.S. President Trump had a profoundly disruptive effect on capital markets in the first quarter. President Trump’s announcement of “Liberation Day,” on April 2, 2025, further exacerbated market apprehensions as the quarter drew to a close. While the Administration argues that these measures will bolster U.S. domestic industries, critics warned of potential repercussions, including higher prices and lower incomes for American families. Threats and counter threats led to significant volatility in global stock markets, with major indices in the U.S. and Japan experiencing notable declines.

Despite tariff headlines dominating the macro environment, Canada’s TSX60 index managed to deliver a positive return in the quarter. If tariffs were the only factor impacting markets, it would be reasonable to expect Canada – being consistently in the crosshairs of tariff threats – to be among the equity markets most negatively impacted by this turmoil. Given Canada’s proportionally significant trading relationship with the U.S., the current resilience of its equity markets suggests additional factors are at play. Indeed, Canada’s economy benefited from strong performance in commodities, notably energy and precious metals, which have historically acted as safe havens during periods of geopolitical uncertainty. A weaker Canadian dollar also provided a competitive advantage to Canadian exporters, potentially further supporting the domestic equity market.

Of note, the entirety of the S&P 500’s year-to-date decline can be attributed to the underperformance of its largest constituents: the so-called “Magnificent Seven.” In 2024, these seven stocks accounted for over half of the S&P 500’s 25% total return. In the first quarter of 2025, they collectively accounted for over 100% of the YTD decline. In other words, the broader index would have been slightly positive were it not for the sharp pullback in these mega-cap names. This reversal highlights the extent to which market performance has become concentrated at the top and how vulnerable the S&P 500 Index can be when these names falter.

These mega-cap technology stocks saw average YTD declines of approximately 16%, driven by a sharp reversal in investor confidence. This volatility erased approximately $5.8 trillion in market capitalization from peak valuations. Investors have become increasingly cautious, reducing positions in growth and technology stocks and shifting towards defensive and lower-volatility sectors.

Performance of the Magnificent Seven

Tariff uncertainty also significantly impacted global supply chains, prompting numerous multinational corporations to reconsider their manufacturing and sourcing strategies. Companies across industries –from automotive and consumer electronics to apparel – began actively diversifying their operations geographically to mitigate potential disruptions from escalating U.S. protectionist policies. Economists highlighted these shifting supply-chain strategies as a potential structural change, likely to influence global trade patterns beyond this period of adjustment.

Global markets were further influenced by mixed economic signals. While the U.S. economy continued its robust pace, supported by resilient consumer spending and ongoing investments in technology infrastructure, concerns about global growth intensified. Europe faced renewed economic weakness amid rising energy costs and subdued consumer confidence, while emerging markets grappled with currency volatility and capital outflows, further complicated by the strong U.S. dollar.

Central banks worldwide responded cautiously. The U.S. Federal Reserve maintained its hawkish stance due to persistent inflation concerns and economic resilience, signalling potential further rate hikes if inflationary pressures persist. In contrast, the Bank of Canada, faced with slower domestic growth, maintained a more accommodative posture, highlighting the nuanced differences in economic trajectories between neighbouring countries. Elsewhere, monetary policy varied widely: the European Central Bank balanced inflation concerns and sluggish growth by refraining from aggressive moves, while central banks in emerging markets grappled with stabilizing currencies amid volatile capital flows.

In summary, the first quarter of 2025 was characterized by heightened volatility and uncertainty, driven by anticipated trade policies, shifting global supply chains, and broader geopolitical dynamics. These developments underscored the interconnectedness of global markets and the critical need for strategic, resilient investment approaches.

EQUITIES

In navigating this environment, Coleford remains committed to our disciplined, long-term investment philosophy. We focus on companies with strong competitive advantages, resilient business models, and ability to sustain growth independent of short-term market fluctuations.

Our investment team continues rigorous analyses of existing holdings and potential new investments. While acknowledging that every business inevitably faces secondary or tertiary impacts from potential tariffs and broader economic disruptions, our portfolio generally demonstrates lower “direct” vulnerability.

Buying and selling businesses based solely upon Presidential tweets will not be a successful strategy for creating wealth. However, we are mindful of the fact that certain policy decisions, however impulsively they may be presented, can have long-tail impacts on capital investment. We also recognize that the winds can shift relatively quickly. Historically, punishing tariff policies have not outlasted the Administrations that introduced them. Such is the case with the McKinley Tariff Act of 1890 which was replaced by lower tariffs under the Wilson–Gorman Tariff Act of 1894. Similarly, the Smoot–Hawley Tariff Act of 1930 was followed four years later by the Reciprocal Tariff Act, which significantly lowered tariffs through reciprocal international negotiations.

Structural advantages such as superior brand strength, intellectual property, regulatory protection, unique assets, high switching costs, and economies of scale, combined with strong balance sheets remain cornerstones of our investment framework. This strategic positioning ensures our portfolio remains not only resilient amid external shocks but also positioned to capitalize on emerging growth opportunities driven by structural economic changes, innovation, and global policy shifts.

FIXED INCOME

In the U.S., interest rates moderated slightly from the start of the year, however remained persistently high throughout the first quarter. This reflected ongoing strength in the U.S. economy, tight labour market conditions, and a cautious stance by the Federal Reserve. Elevated rates continue to have significant implications for bond markets, asset valuations, and currency dynamics. In particular, high interest rates supported relatively attractive yields in U.S. fixed income portfolios but simultaneously put pressure on equity valuations, particularly in high-duration sectors like technology and growth-oriented businesses.

In contrast, yields in the Canadian fixed income market continued to shift lower in the first quarter. On March 12, 2025, the Bank of Canada reduced its target for the overnight rate by 25 basis points to 2.75%. This marked the seventh consecutive rate cut since June 2024, and the 2nd reduction of the year, aimed at mitigating the economic uncertainty stemming from recent U.S. tariff threats. These rate reductions were intended to support Canadians in managing the challenges posed by trade tensions and were enacted despite concerns about potential inflationary outcomes. The Bank’s Governing Council emphasized the need for careful monitoring of the economy and indicated that future policy guidance would be inappropriate under the current circumstances.

CLOSING THOUGHTS

As we advance through 2025, our approach remains clear: navigating uncertainty with discipline, maintaining rigorous investment criteria, and staying committed to the long-term financial objectives of our clients. History demonstrates that periods of volatility and disruption often present opportunities for discerning investors. We are positioned to seize these opportunities while ensuring our clients’ portfolios remain resilient, well diversified, and strategically aligned to long-term wealth creation and preservation.