The third quarter of 2024 featured both headline-grabbing stock market highs – with the S&P 500 closing the quarter at an all-time high and the S&P TSX 60 touching its own all-time high in the final week of September – and significant underlying market volatility. This puzzling dichotomy between bullish aggregate performance and volatility at levels not seen since 2020 reveals a complex economic backdrop and heightened sensitivity to macroeconomic factors.

Looking closer, it appears that the volatility spike (illustrated in the table below) was driven by fears of slowing economic growth, concerns over central bank monetary policies, and geopolitical tensions. Early in the quarter, the U.S. Federal Reserve’s perceived delay in cutting interest rates exacerbated market uncertainty. Although inflation continued to moderate, investors worried about the potential for a recession induced by tight monetary policy, which triggered significant fluctuations across asset classes.

CBOE Volatility Index – 5 Year Chart

Volatility in North American capital markets also reflected broader concerns about the global economy and diverging central bank policies, particularly between the U.S. Federal Reserve and the Bank of Japan. While the Fed was expected to cut rates toward the end of the year, it remained cautious amid elevated inflation and wage growth concerns.

In contrast, the Bank of Japan continued its more accommodative stance, resulting in currency volatility and shifts in global capital flows. Pressure was also felt in emerging markets, which saw capital outflows due to the strength of the U.S. dollar.

Despite these challenges, the S&P 500 powered through and had its best start to the year this century. This surprising strength was largely driven by continued resilience in corporate earnings and optimism about a soft landing for the U.S. economy. Investors remained optimistic about the potential for a moderate slowdown rather than a deep recession, which kept risk assets attractive despite the rising volatility.

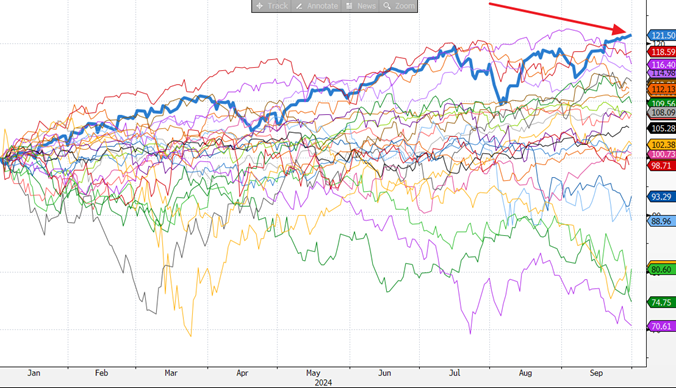

S&P 500 Price Changes – Q1 to Q3 since 2000

Increased volatility also reflected rising geopolitical uncertainty, particularly in Eastern Europe and the Middle East, which added to market fragility. Moreover, the U.S. political landscape continued to be a source of concern as investors braced for the outcome of the 2024 presidential election, with significant policy differences between the leading candidates making it difficult to determine, with any degree of certainty, the direction of U.S. fiscal and trade policies to come from the next American administration.

EQUITIES

Equity markets experienced a notable shift during the quarter reflecting a rotation of investment from large mega-capitalization stocks to shares of everything else – in particular smaller companies. This occurred amidst concerns over the sustainability of growth, particularly in large technology companies. Those companies dominated equity market gains earlier in the year. Meantime, July saw renewed hopes of a soft landing for the U.S. economy, which spurred a rally in smaller, more cyclically sensitive stocks. However, this optimism quickly faded as economic data in August and September signaled a more mixed outlook. This was the third significant equity rotation in the last 12 months, following previous changes in November-December 2023 and April 2024.

Momentum-driven investment strategies, which have been heavily concentrated in the mega-cap technology stock space, saw a sharp unwinding during the quarter. Investors began to rotate out of these crowded trades, seeking exposure to smaller, more value-oriented names. This shift was partially driven by a growing belief that mega-cap stocks had become overvalued, especially as earnings expectations for the second half of 2024 and into 2025 remained elevated. The act of unwinding momentum positions caused some of the largest names in the market, including Nvidia and Apple, to underperform relative to their smaller peers.

Smaller companies (as measured by market capitalizations), benefited from this rotation, as investors sought to diversify away from highly concentrated positions in large-cap growth stocks. Despite this rotation, small caps faced their own set of challenges including the risk of an economic slowdown. Historically, small caps underperform in environments where economic growth decelerates. As such, while small caps outperformed during certain periods in the quarter, the overall outlook for that sector remained cautious.

The value of companies engaged in artificial intelligence, which had been bid up aggressively in the first half of 2024, experienced a pullback as investor enthusiasm waned. However, the long-term secular growth story surrounding AI and digital transformation remains promising, suggesting that technology could reemerge as a leader once the market stabilizes.

In conclusion, while the rotation from mega-cap stocks to smaller, more cyclically sensitive names reflects the broader market’s evolving concerns about growth and valuation, it also underscores the importance of disciplined portfolio construction. The Coleford Equity Portfolio’s focus on selecting a diversified group of structurally advantaged businesses positions it well to navigate these shifting dynamics. By maintaining a long-term view and emphasizing companies with enduring competitive advantages, the portfolio aims to capture opportunities that arise during periods of market rotation, while mitigating the risks associated with rapid changes in market sentiment.

FIXED INCOME

Fixed income markets were defined by a significant decline in bond yields, particularly in Canada, where the 5-year government bond yield fell below 3% — ending the quarter at 2.74% This drop in yields reflected growing concerns about the sustainability of economic growth both domestically and globally. Investors flocked to safer assets like government bonds, which are traditionally viewed as a hedge against economic uncertainty and equity market volatility.

The sharp decline in Canadian bond yields can also be attributed to a reassessment of future interest rate paths by the Bank of Canada. As inflation showed signs of moderating, market participants began to anticipate a more dovish stance from the central bank, including the potential for as many as three rate cuts later in the year aggregating 75 basis points. This shift in expectations provided support to the bond market, driving yields lower and pushing bond prices higher. Additionally, the strength of the Canadian dollar against the U.S. dollar during the quarter attracted international investors to Canadian fixed income, further supporting demand.

Global bond markets followed a similar pattern, with yields dropping across most developed economies. In the U.S., treasury yields declined as investors sought safe havens amidst rising geopolitical tensions and concerns about the Federal Reserve’s policy path.

Overall, bond market sentiment was one of caution, with investors remaining wary of both inflation risks and the potential for a recession. As central banks in developed markets moved closer to the end of their tightening cycles, fixed-income assets became more attractive, particularly for income-focused investors seeking to lock in higher yields before rates dropped even further. The decline in yields also had a knock-on effect on corporate bonds, with investment-grade and high-yield spreads tightening as credit risk diminished.

CLOSING THOUGHTS

The third quarter of 2024 was a period of contrasts, with record highs in equity markets contrasted against surging volatility and declining bond yields. Investors were caught between optimism driven by strong corporate earnings and fears of an economic slowdown. The rotation from mega-cap to small-cap stocks highlighted the shifting sentiment in equity markets, while fixed income benefited from a flight to safety as bond yields declined across major economies.

Looking ahead to Q4, market participants will likely continue to navigate a complex environment shaped, as always, by central bank policies, geopolitical risks, the evolving economic landscape and the prospects for corporate earnings growth.

Taking all of this into account, Coleford will continue to adhere to our approach of owning structurally advantaged companies, believing that this principled stand is far superior, over the long term, to chasing fads or riding the rollercoaster of momentum stocks, large or small.

On matters of style, swim with the current. On matters of principle, stand like a rock.

– Thomas Jefferson –

2024 Q3 Coleford Quarterly Commentary

Quarterly Commentary

THIRD QUARTER 2024

Executive Summary

Conservative. Consistent. Committed.

PORTFOLIO MANAGEMENT TEAM

MACRO ENVIRONMENT

The third quarter of 2024 featured both headline-grabbing stock market highs – with the S&P 500 closing the quarter at an all-time high and the S&P TSX 60 touching its own all-time high in the final week of September – and significant underlying market volatility. This puzzling dichotomy between bullish aggregate performance and volatility at levels not seen since 2020 reveals a complex economic backdrop and heightened sensitivity to macroeconomic factors.

Looking closer, it appears that the volatility spike (illustrated in the table below) was driven by fears of slowing economic growth, concerns over central bank monetary policies, and geopolitical tensions. Early in the quarter, the U.S. Federal Reserve’s perceived delay in cutting interest rates exacerbated market uncertainty. Although inflation continued to moderate, investors worried about the potential for a recession induced by tight monetary policy, which triggered significant fluctuations across asset classes.

CBOE Volatility Index – 5 Year Chart

Volatility in North American capital markets also reflected broader concerns about the global economy and diverging central bank policies, particularly between the U.S. Federal Reserve and the Bank of Japan. While the Fed was expected to cut rates toward the end of the year, it remained cautious amid elevated inflation and wage growth concerns.

In contrast, the Bank of Japan continued its more accommodative stance, resulting in currency volatility and shifts in global capital flows. Pressure was also felt in emerging markets, which saw capital outflows due to the strength of the U.S. dollar.

Despite these challenges, the S&P 500 powered through and had its best start to the year this century. This surprising strength was largely driven by continued resilience in corporate earnings and optimism about a soft landing for the U.S. economy. Investors remained optimistic about the potential for a moderate slowdown rather than a deep recession, which kept risk assets attractive despite the rising volatility.

S&P 500 Price Changes – Q1 to Q3 since 2000

Increased volatility also reflected rising geopolitical uncertainty, particularly in Eastern Europe and the Middle East, which added to market fragility. Moreover, the U.S. political landscape continued to be a source of concern as investors braced for the outcome of the 2024 presidential election, with significant policy differences between the leading candidates making it difficult to determine, with any degree of certainty, the direction of U.S. fiscal and trade policies to come from the next American administration.

EQUITIES

Equity markets experienced a notable shift during the quarter reflecting a rotation of investment from large mega-capitalization stocks to shares of everything else – in particular smaller companies. This occurred amidst concerns over the sustainability of growth, particularly in large technology companies. Those companies dominated equity market gains earlier in the year. Meantime, July saw renewed hopes of a soft landing for the U.S. economy, which spurred a rally in smaller, more cyclically sensitive stocks. However, this optimism quickly faded as economic data in August and September signaled a more mixed outlook. This was the third significant equity rotation in the last 12 months, following previous changes in November-December 2023 and April 2024.

Momentum-driven investment strategies, which have been heavily concentrated in the mega-cap technology stock space, saw a sharp unwinding during the quarter. Investors began to rotate out of these crowded trades, seeking exposure to smaller, more value-oriented names. This shift was partially driven by a growing belief that mega-cap stocks had become overvalued, especially as earnings expectations for the second half of 2024 and into 2025 remained elevated. The act of unwinding momentum positions caused some of the largest names in the market, including Nvidia and Apple, to underperform relative to their smaller peers.

Smaller companies (as measured by market capitalizations), benefited from this rotation, as investors sought to diversify away from highly concentrated positions in large-cap growth stocks. Despite this rotation, small caps faced their own set of challenges including the risk of an economic slowdown. Historically, small caps underperform in environments where economic growth decelerates. As such, while small caps outperformed during certain periods in the quarter, the overall outlook for that sector remained cautious.

The value of companies engaged in artificial intelligence, which had been bid up aggressively in the first half of 2024, experienced a pullback as investor enthusiasm waned. However, the long-term secular growth story surrounding AI and digital transformation remains promising, suggesting that technology could reemerge as a leader once the market stabilizes.

In conclusion, while the rotation from mega-cap stocks to smaller, more cyclically sensitive names reflects the broader market’s evolving concerns about growth and valuation, it also underscores the importance of disciplined portfolio construction. The Coleford Equity Portfolio’s focus on selecting a diversified group of structurally advantaged businesses positions it well to navigate these shifting dynamics. By maintaining a long-term view and emphasizing companies with enduring competitive advantages, the portfolio aims to capture opportunities that arise during periods of market rotation, while mitigating the risks associated with rapid changes in market sentiment.

FIXED INCOME

Fixed income markets were defined by a significant decline in bond yields, particularly in Canada, where the 5-year government bond yield fell below 3% — ending the quarter at 2.74% This drop in yields reflected growing concerns about the sustainability of economic growth both domestically and globally. Investors flocked to safer assets like government bonds, which are traditionally viewed as a hedge against economic uncertainty and equity market volatility.

The sharp decline in Canadian bond yields can also be attributed to a reassessment of future interest rate paths by the Bank of Canada. As inflation showed signs of moderating, market participants began to anticipate a more dovish stance from the central bank, including the potential for as many as three rate cuts later in the year aggregating 75 basis points. This shift in expectations provided support to the bond market, driving yields lower and pushing bond prices higher. Additionally, the strength of the Canadian dollar against the U.S. dollar during the quarter attracted international investors to Canadian fixed income, further supporting demand.

Global bond markets followed a similar pattern, with yields dropping across most developed economies. In the U.S., treasury yields declined as investors sought safe havens amidst rising geopolitical tensions and concerns about the Federal Reserve’s policy path.

Overall, bond market sentiment was one of caution, with investors remaining wary of both inflation risks and the potential for a recession. As central banks in developed markets moved closer to the end of their tightening cycles, fixed-income assets became more attractive, particularly for income-focused investors seeking to lock in higher yields before rates dropped even further. The decline in yields also had a knock-on effect on corporate bonds, with investment-grade and high-yield spreads tightening as credit risk diminished.

CLOSING THOUGHTS

The third quarter of 2024 was a period of contrasts, with record highs in equity markets contrasted against surging volatility and declining bond yields. Investors were caught between optimism driven by strong corporate earnings and fears of an economic slowdown. The rotation from mega-cap to small-cap stocks highlighted the shifting sentiment in equity markets, while fixed income benefited from a flight to safety as bond yields declined across major economies.

Looking ahead to Q4, market participants will likely continue to navigate a complex environment shaped, as always, by central bank policies, geopolitical risks, the evolving economic landscape and the prospects for corporate earnings growth.

Taking all of this into account, Coleford will continue to adhere to our approach of owning structurally advantaged companies, believing that this principled stand is far superior, over the long term, to chasing fads or riding the rollercoaster of momentum stocks, large or small.