Two Pillars of Market Strength

During the third quarter, investor confidence in the potential of artificial intelligence (AI) and expectations of lower interest rates not only supported resilient (and rising) stock markets but served as pillars that appear to have redefined the source of market leadership.

AI: The Engine Behind Market Resilience

AI has evolved from an emerging technology into the backbone of market performance. Since the launch of ChatGPT in late 2022, AI-related companies have accounted for 75% of S&P 500 returns, 80% of earnings growth, and 90% of capital spending growth. This unprecedented concentration has created a top-heavy market where a handful of tech names drives index returns.

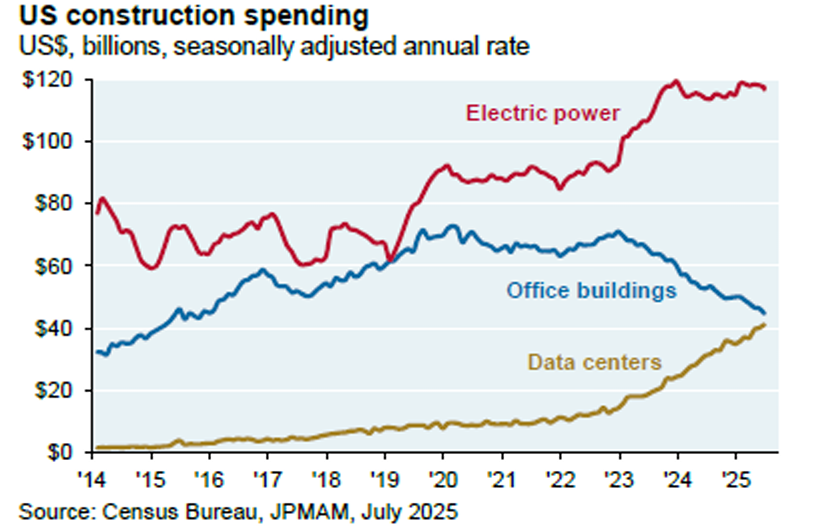

The implications for the broader economy and equity markets are far-reaching as AI’s influence moves beyond software and semiconductors to physical infrastructure and energy demand. Construction spending on data centers is now outpacing office buildings, while AI’s energy requirements are straining power grids and pushing utilities into the spotlight. This surge in capital investment has created ripple effects across sectors, benefiting industrials, materials and regulated utilities.

This AI-driven rally masks a more nuanced economic backdrop. Beneath the surface, traditional sectors are showing signs of strain. Manufacturing activity outside of technology-related construction remains subdued, and consumer spending is beginning to soften. The U.S. economy, while still expanding, is showing signs of deceleration. Labour market data has been mixed, with job creation slowing and wage growth plateauing. Despite these cracks, investor enthusiasm remains undeterred. The narrative has shifted from “AI is coming” to “AI is essential,” and companies are racing to build infrastructure, secure talent, and monetize new capabilities. For now, AI remains a powerful tailwind, even as broader economic indicators flash yellow.

Interest Rates: Policy, Politics and Perception

The second pillar of current market strength is the political push for lower interest rates. While central banks maintain their independence in theory, the reality may be different. President Trump has made it clear that lower rates are a priority, and whether through direct influence or indirect pressure, the market is responding. This dynamic has created a paradox. U.S. inflation remains above target, yet the political will to stimulate growth is overpowering traditional monetary caution. Investors are betting that rates will fall, and that bet is being rewarded in sectors sensitive to discount rates and capital flows.

Canada: Gold, Infrastructure, Fragility

In Canada, the macro picture is different. Relative to the U.S., Bank of Canada monetary easing is further along and domestic short-term interest rates have declined sharply. This has supported dividendpaying stocks and defensive sectors like utilities and pipelines, which benefit from lower borrowing costs.However, the Canadian dollar remains weak andeconomic momentum is fragile. GDP growth has been tepid, and recent indicators suggest theeconomy is “bumbling along” rather than accelerating.

Amid this softness, the materials sector stood out, led by a powerful rally in gold. Gold prices have surged nearly 40% year to date, lifting the S&P/TSX Global Gold Index by 120%. The materials sector has been a major driver of Canadian equity performance, accounting for over one-third of the S&P/TSX 60’s total return year to date. Within this sector, gold stocks have been the single most important driver of performance.

However, history has shown that these assets are highly cyclical, and their returns are often driven more by macro sentiment and commodity flows than corporate fundamentals. Forecasting the price of gold is, in our view, a highly speculative exercise that rarely rewards discipline. Our investment philosophy favours businesses with durable cash flows, strategic moats, and predictable earnings; not stocks whose fortunes hinge on the next move in commodity markets.

Meantime, construction spending continues to play a critical role in Canada’s interest rate-sensitive economy. Lower borrowing costs have unlocked capital for infrastructure projects, especially in energy and digital infrastructure. Both federal and provincial governments have announced capital investment intentions while encouraging private sector involvement. This potential surge in construction may help to offset weakness in other areas and provide a floor for Canadian economic activity. Together, gold and infrastructure are acting as stabilizers in an otherwise fragile economic environment. As always, we remain selective in our participation in the latter and eschew the former.

EQUITIES

Against this backdrop, we’ve made several strategic adjustments to the portfolio: trimming high-flying tech names and adding exposure to defensive, cash-generative businesses.

Trimming Oracle and Alphabet

Oracle and Alphabet have been standout performers. Oracle, in particular, surprised the market with a backlog announcement that sent the stock soaring nearly 45% in a single day. Alphabet continues to benefit from secular trends in digital advertising and cloud services. However, strong performance can lead to outsized positions and elevated risk. As part of our disciplined process, we took this opportunity to trim our investment in Oracle by 3% and Alphabet by 1%. These moves are not a retreat from AI; they are a recalibration. We maintain meaningful exposure to both names, but we’ve taken gains and reduced concentration risk. In general, this is about improving the quality of the

Portfolio. High-growth stocks can be volatile, especially when momentum fades or narratives shift – as an example, in the first four months of the year Oracle saw its value decline by over a third as investors questions the ongoing build out of its AI business. By trimming, we reduce exposure to potential whipsaws while preserving upside participation.

Adding Fortis and Canadian Pacific Kansas City

To balance the portfolio, and in keeping with our commitment to investing in structurally advantaged companies, we added two Canadian names that offer stability, income, and strategic diversification: Fortis Inc. and Canadian Pacific Kansas City.

Fortis is a regulated utility with operations across Canada, the U.S., and the Caribbean. Nearly all of its earnings come from regulated assets, and its transmission and distribution focus provides predictable cash flows. The company is executing a $26 billion capital plan through 2029, targeting 6.5% annual growth. It also offers a reliable dividend stream, with 4 to 6% annual growth guidance.

Canadian Pacific Kansas City is the only single-line freight railway connecting Canada, the U.S., and Mexico. Its network reach, pricing power, and exposure to North American trade lanes make it a compelling infrastructure-like investment. The company is investing in technology, sustainability, and capacity expansion, all while maintaining disciplined financial management. Together, these two additions

- Improve sector balance

- Increase Canadian dollar exposure

- Lower portfolio volatility

- Enhance income via Fortis’ dividend.

We believe rebalancing and thoughtful reallocation to businesses that are cheaper and less risky is prudent at this time.

FIXED INCOME

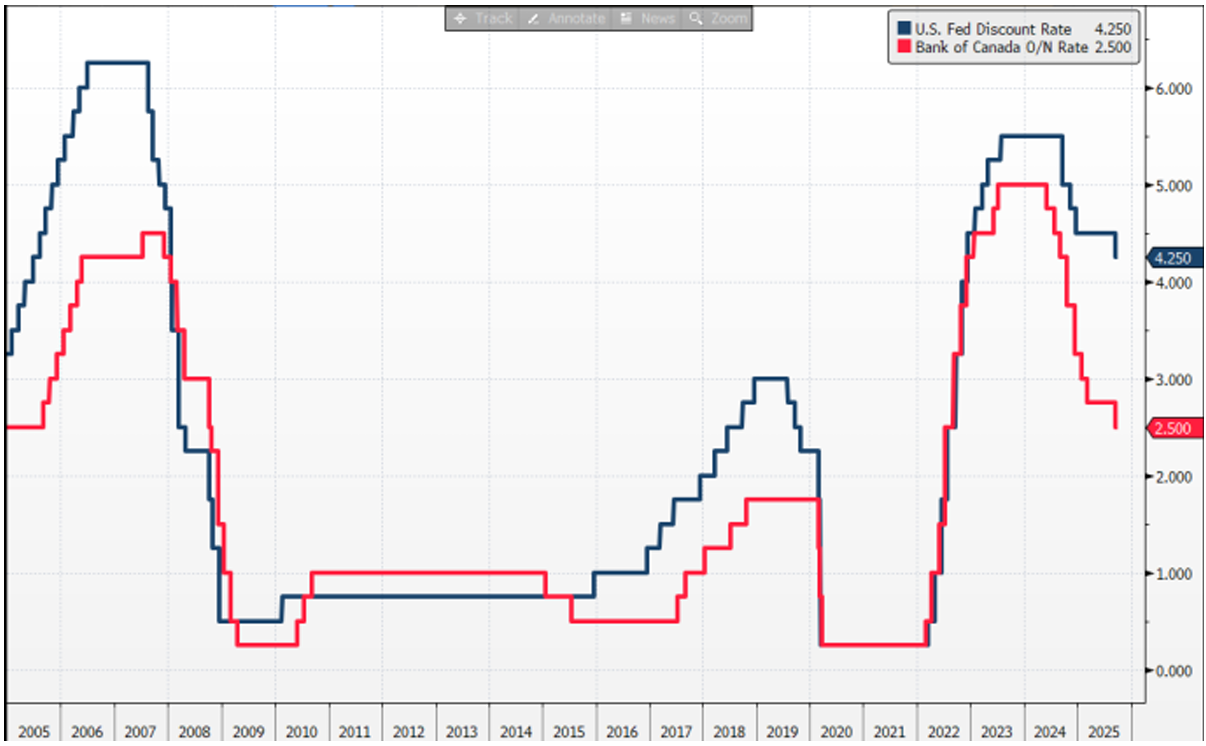

In the third quarter, both the Federal Reserve and the Bank of Canada reduced interest rates. Despite these moves, the rate gap between the two countries remains wide. The Fed has kept its discount rate higher, reflecting its ongoing concern with persistent inflation and the strength of the U.S. economy. The Bank of Canada, meanwhile, has lowered its overnight rate to 2.50% in response to weaker domestic conditions and softer growth.

This divergence (shown in the chart below) leaves investors with a meaningful policy spread to navigate, one that continues to shape relative fixed income valuations, currency flows, and yield opportunities across North America. The persistence of this gap is especially notable when placed in historical context. The last time Canada’s policy rate stood so far below that of the United States was in the mid-2000s, a period that eventually gave way to the global financial crisis and a swift convergence of rates. While today’s backdrop differs, the parallel with yesteryear highlights the fact that wide and sustained rate differentials can heighten volatility and contribute to shifts in investor behavior.

CLOSING THOUGHTS

When investing, it is important to consider macroeconomic and industry/sectoral factors such as the ones described in this issue. But to build generational wealth requires something more: the discipline to critically evaluate individual investment opportunities to ensure they are able to deliver performance now, over the next economic cycle, and the next. By holding structurally advantaged businesses, now including Fortis and Canadian Pacific Kansas City, Coleford is positioned for the future.

The most contrarian thing of all is not to oppose the crowd but to think for yourself.

– Peter Thiel –

2025 Q3 Coleford Quarterly Commentary

Quarterly Commentary

THIRD QUARTER 2025

Executive Summary

Conservative. Consistent. Committed.

PORTFOLIO MANAGEMENT TEAM

MACRO ENVIRONMENT

Two Pillars of Market Strength

During the third quarter, investor confidence in the potential of artificial intelligence (AI) and expectations of lower interest rates not only supported resilient (and rising) stock markets but served as pillars that appear to have redefined the source of market leadership.

AI: The Engine Behind Market Resilience

AI has evolved from an emerging technology into the backbone of market performance. Since the launch of ChatGPT in late 2022, AI-related companies have accounted for 75% of S&P 500 returns, 80% of earnings growth, and 90% of capital spending growth. This unprecedented concentration has created a top-heavy market where a handful of tech names drives index returns.

The implications for the broader economy and equity markets are far-reaching as AI’s influence moves beyond software and semiconductors to physical infrastructure and energy demand. Construction spending on data centers is now outpacing office buildings, while AI’s energy requirements are straining power grids and pushing utilities into the spotlight. This surge in capital investment has created ripple effects across sectors, benefiting industrials, materials and regulated utilities.

This AI-driven rally masks a more nuanced economic backdrop. Beneath the surface, traditional sectors are showing signs of strain. Manufacturing activity outside of technology-related construction remains subdued, and consumer spending is beginning to soften. The U.S. economy, while still expanding, is showing signs of deceleration. Labour market data has been mixed, with job creation slowing and wage growth plateauing. Despite these cracks, investor enthusiasm remains undeterred. The narrative has shifted from “AI is coming” to “AI is essential,” and companies are racing to build infrastructure, secure talent, and monetize new capabilities. For now, AI remains a powerful tailwind, even as broader economic indicators flash yellow.

Interest Rates: Policy, Politics and Perception

The second pillar of current market strength is the political push for lower interest rates. While central banks maintain their independence in theory, the reality may be different. President Trump has made it clear that lower rates are a priority, and whether through direct influence or indirect pressure, the market is responding. This dynamic has created a paradox. U.S. inflation remains above target, yet the political will to stimulate growth is overpowering traditional monetary caution. Investors are betting that rates will fall, and that bet is being rewarded in sectors sensitive to discount rates and capital flows.

Canada: Gold, Infrastructure, Fragility

In Canada, the macro picture is different. Relative to the U.S., Bank of Canada monetary easing is further along and domestic short-term interest rates have declined sharply. This has supported dividendpaying stocks and defensive sectors like utilities and pipelines, which benefit from lower borrowing costs.However, the Canadian dollar remains weak andeconomic momentum is fragile. GDP growth has been tepid, and recent indicators suggest theeconomy is “bumbling along” rather than accelerating.

Amid this softness, the materials sector stood out, led by a powerful rally in gold. Gold prices have surged nearly 40% year to date, lifting the S&P/TSX Global Gold Index by 120%. The materials sector has been a major driver of Canadian equity performance, accounting for over one-third of the S&P/TSX 60’s total return year to date. Within this sector, gold stocks have been the single most important driver of performance.

However, history has shown that these assets are highly cyclical, and their returns are often driven more by macro sentiment and commodity flows than corporate fundamentals. Forecasting the price of gold is, in our view, a highly speculative exercise that rarely rewards discipline. Our investment philosophy favours businesses with durable cash flows, strategic moats, and predictable earnings; not stocks whose fortunes hinge on the next move in commodity markets.

Meantime, construction spending continues to play a critical role in Canada’s interest rate-sensitive economy. Lower borrowing costs have unlocked capital for infrastructure projects, especially in energy and digital infrastructure. Both federal and provincial governments have announced capital investment intentions while encouraging private sector involvement. This potential surge in construction may help to offset weakness in other areas and provide a floor for Canadian economic activity. Together, gold and infrastructure are acting as stabilizers in an otherwise fragile economic environment. As always, we remain selective in our participation in the latter and eschew the former.

EQUITIES

Against this backdrop, we’ve made several strategic adjustments to the portfolio: trimming high-flying tech names and adding exposure to defensive, cash-generative businesses.

Trimming Oracle and Alphabet

Oracle and Alphabet have been standout performers. Oracle, in particular, surprised the market with a backlog announcement that sent the stock soaring nearly 45% in a single day. Alphabet continues to benefit from secular trends in digital advertising and cloud services. However, strong performance can lead to outsized positions and elevated risk. As part of our disciplined process, we took this opportunity to trim our investment in Oracle by 3% and Alphabet by 1%. These moves are not a retreat from AI; they are a recalibration. We maintain meaningful exposure to both names, but we’ve taken gains and reduced concentration risk. In general, this is about improving the quality of the

Portfolio. High-growth stocks can be volatile, especially when momentum fades or narratives shift – as an example, in the first four months of the year Oracle saw its value decline by over a third as investors questions the ongoing build out of its AI business. By trimming, we reduce exposure to potential whipsaws while preserving upside participation.

Adding Fortis and Canadian Pacific Kansas City

To balance the portfolio, and in keeping with our commitment to investing in structurally advantaged companies, we added two Canadian names that offer stability, income, and strategic diversification: Fortis Inc. and Canadian Pacific Kansas City.

Fortis is a regulated utility with operations across Canada, the U.S., and the Caribbean. Nearly all of its earnings come from regulated assets, and its transmission and distribution focus provides predictable cash flows. The company is executing a $26 billion capital plan through 2029, targeting 6.5% annual growth. It also offers a reliable dividend stream, with 4 to 6% annual growth guidance.

Canadian Pacific Kansas City is the only single-line freight railway connecting Canada, the U.S., and Mexico. Its network reach, pricing power, and exposure to North American trade lanes make it a compelling infrastructure-like investment. The company is investing in technology, sustainability, and capacity expansion, all while maintaining disciplined financial management. Together, these two additions

We believe rebalancing and thoughtful reallocation to businesses that are cheaper and less risky is prudent at this time.

FIXED INCOME

In the third quarter, both the Federal Reserve and the Bank of Canada reduced interest rates. Despite these moves, the rate gap between the two countries remains wide. The Fed has kept its discount rate higher, reflecting its ongoing concern with persistent inflation and the strength of the U.S. economy. The Bank of Canada, meanwhile, has lowered its overnight rate to 2.50% in response to weaker domestic conditions and softer growth.

This divergence (shown in the chart below) leaves investors with a meaningful policy spread to navigate, one that continues to shape relative fixed income valuations, currency flows, and yield opportunities across North America. The persistence of this gap is especially notable when placed in historical context. The last time Canada’s policy rate stood so far below that of the United States was in the mid-2000s, a period that eventually gave way to the global financial crisis and a swift convergence of rates. While today’s backdrop differs, the parallel with yesteryear highlights the fact that wide and sustained rate differentials can heighten volatility and contribute to shifts in investor behavior.

CLOSING THOUGHTS

When investing, it is important to consider macroeconomic and industry/sectoral factors such as the ones described in this issue. But to build generational wealth requires something more: the discipline to critically evaluate individual investment opportunities to ensure they are able to deliver performance now, over the next economic cycle, and the next. By holding structurally advantaged businesses, now including Fortis and Canadian Pacific Kansas City, Coleford is positioned for the future.